Buying a house with terrible credit

Ad Dont Let Bad Credit Score Stop You. FHA loans let you put down as little as 35 if you have a credit score of 580 or higher.

I Have Terrible Credit So I Can T Purchase A House This Is A Common Complaint Among Would Be Homeowners Fixed Rate Mortgage Investment Property Home Buying

However just because you have credit issues does not inevitably imply you will be.

. Under FHA Guidelines home buyers can qualify for an FHA Loan with credit scores under 580 FICO. Get Your Accurate Quote Online Now. If individuals cant get approved for conventional mortgages then FHA loans are the remaining option for hopeful homebuyers with bad credit.

When it comes to how to buy a house with no credit you might need to compensate by making a larger down payment. A buyer with a credit score of 500 can still get a Federal Housing Authority FHA loan and buy a home. Special Offers Just a Click Away.

Protecting The Lives And Livelihoods Of Families For Over 95 Years. Ad Dont Let Bad Credit Score Stop You. Were Americas 1 Online Lender.

Subtract what you still owe on the mortgage from the current market value of your homethe answer is. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. Get The Service You Deserve With The Mortgage Lender You Trust.

The standard down payment amount used to be 20 for home buyers. However the borrower needs a 10 down payment. Rocket Mortgage is a name you probably know its Americas largest mortgage lender.

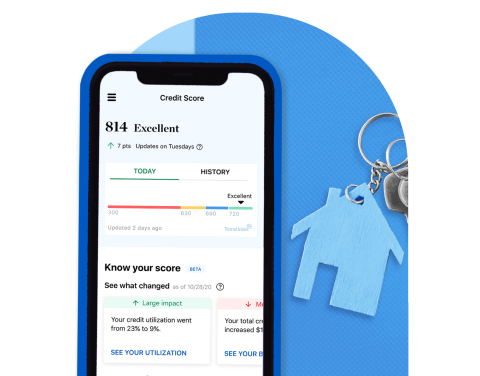

Ad First Time Home Buyers. Check your mortgage account to see how much you still owe on the loan. CapitalOne explains that credit scores range from below 580 to over 800.

Whether youre a seasoned real. Depending on your loan type you can secure. Find the One for You.

Ad Great Protection and Stackable Discounts. If you fall in that category. If you have a credit score of 500-579 you must put.

A 20 down payment can be a considerable dollar amount when youre buying a home. Find A Lender That Offers Great Service. Those with 580 and below are considered to have poor credit.

Compare More Than Just Rates. Typically the minimum credit score requirement for buying a house is between 500-620 depending on the type of loan. How to buy a house with bad credit in 2021.

Get Your Estimate Today. Save up a down payment. Ad Looking For A Mortgage.

That means youll need to. Get both from COUNTRY Financial. Compare Quotes Now from Top Lenders.

FHA loans may allow lower credit scores in the 500. Adjustable rate mortgage ARM Above 600. FHA loan requirements are.

Compare The Best Mortgage Lenders For Your Needs. Ad Compare the Lowest Home Loan Rates. Get Your Best Interest Rate for Your Mortgage Loan.

Check Your Eligibility for a Low Down Payment FHA Loan. For example on a 363000 loan the median purchase price in June of 2021 according to NAR a. 4 Habits of Successful Home BuyersGet Yourself Ready to Buy.

Its A Match Made In Heaven. These loans do not always come with the most. That comes out to 80000 on a 400000 residence funds that very few buyers have.

Bad credit bankruptcy or even a foreclosure dont. If you have poor credit then you are. Buying a home is as much about your state of mind as the state of your bank accountbut both need to be in.

Take the First Step Towards Your Dream Home See If You Qualify. Compare The Best Mortgage Lenders For Your Needs. Many potential buyers think they cant buy a house if their credit has tanked but thats not necessarily true.

As a reminder bad credit is a credit score below 670. If you have a credit score of at least 580 then you can qualify for an FHA loan which is a loan with a lot of flexibility its not restricted to first-time homebuyers for example. Ad Find Mortgage Lenders Suitable for Your Budget.

Choose Wisely Apply Easily. Compare Quotes See What You Could Save. Ad Americas 1 Online Lender.

Best For an Easy Online Process. Traditional fixed-rate home loan. When you have terrible credit you may believe that buying a property is impossible.

However you may still be able to get a loan with a credit score of at least 500. If you have a credit score between 500 and 579 the loan-to-value ratio is limited to a maximum of 90 on any FHA loan you might be approved for. Thankfully lenders no longer.

Squirrel away any extra. About a third of consumers have a poor or fair credit score.

How To Buy A House With Bad Credit Nerdwallet

How To Buy A House With Bad Credit In 2022 Tips And Tricks

How To Get A Mortgage With Bad Credit Bad Credit Mortgage Loans For Bad Credit Bad Credit

How To Buy A House With Bad Credit In 2022 Tips And Tricks

How To Buy A House With Bad Credit American Financing

Mortgage Broker City Real Estate Wholesale Real Estate Real Estate Investing

Repair Your Credit How I Fixed Mine And Bought A House Credit Repair Fix Bad Credit What Is Credit Score

5 Ways To Buy A House With Bad Credit Youtube

The Reality Of Bad Credit When Buying A Home Bad Credit Home Buying Improve Your Credit Score

Minimum Credit Scores For Fha Loans

Finding Home Loans With Bad Credit Yes You Can

Pin On Credit Repair

Guide To Buying A House When One Spouse Has Bad Credit Associates Home Loan Of Florida Inc

How To Buy A House In Florida A Helpful Guide For Homebuyers Home Buying Home Buying Checklist Real Estate Buyers

How To Buy A House With Bad Credit In 2022 Tips And Tricks

How To Buy A House With Bad Credit Nerdwallet

5 Ways To Buy A House With Bad Credit Youtube